STATE OF INDIAN ECONOMY

INDIAN ECONOMY AT A GLANCE

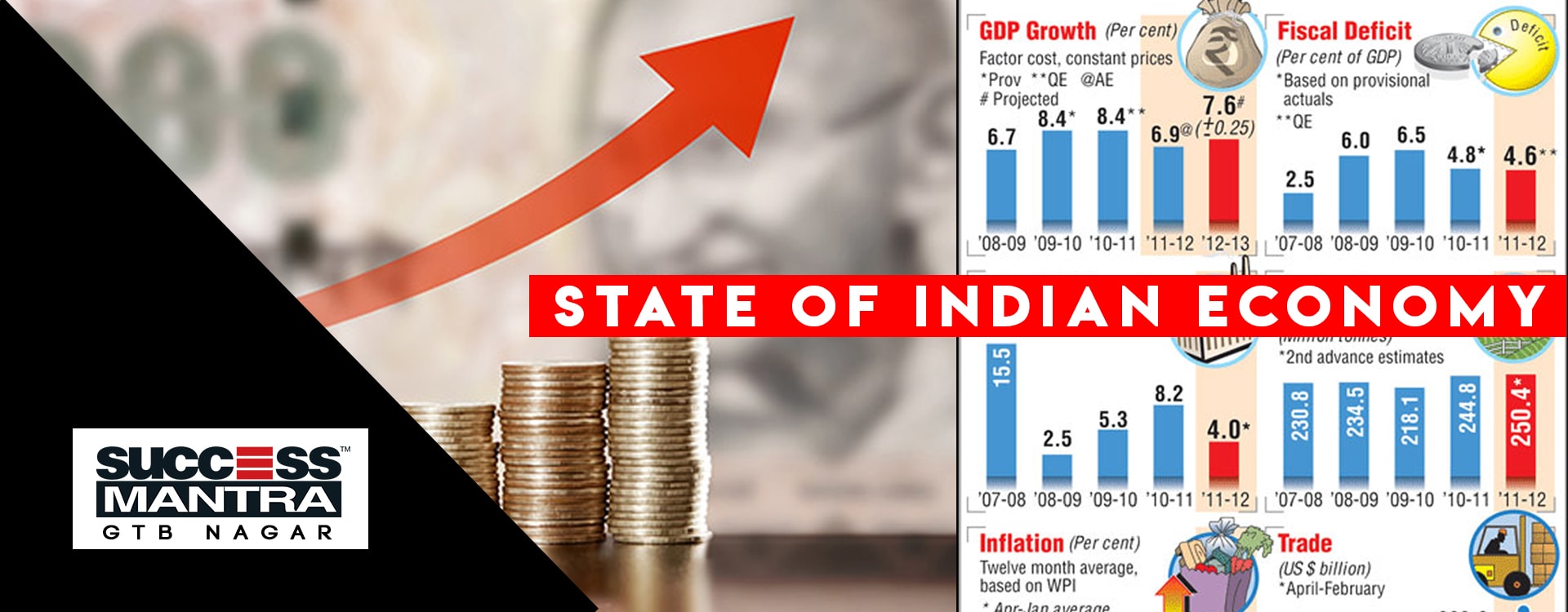

GDP is the Gross Domestic Product. It is the sum of private consumption expenditure, investment, government expenditure and net exports (exports minus imports). Over the last one quarter India has been witnessing a slowdown in its growth. With high targets as $5 trillion economy by 2025, India seems to be struggling to keep pace with its economic growth.. Let’s have a look at the different forecast for India:

- In the latest bi-monthly monetary policy of RBI, it lowered India's GDP growth estimate for the year to 6.1% from the earlier figure of 6.9% due to the on-going period of economic slowdown.

- The International Monetary Fund (IMF) has cut its projection for India’s economic growth to 7% for 2019-20.

- S&P Global Ratings reduced India’s growth projection for 2019-20 from 7.1% to 6.3%, but said it expected a decent recovery in 2020-21 to 7%.

- Moody's Investors Service cut India's GDP growth forecast for 2019 calendar year to 6.2%.

- Asian Development Bank (ADB) lowered India’s growth rate at 6.5% during current fiscal of 2019-20.

- CRISIL lowered India’s GDP forecast for 2019-20 to 6.9%.

- The eight core sector industries, coal, crude oil, natural gas, refinery products, fertilizer, steel, cement and electricity, has been recorded at minus 0.5% against 4.7% in August last year. The Key sectors bearing the brunt of Indian Economy slow down are Agriculture, Automobile, Real Estate, FMCG among others

The above numbers by the reputed national and international agencies have shed light on India’s worrying GDP growth due to the slowdown. The growth of the Indian economy had been predominated by consumption inclusive of both -- Private Final Consumption Expenditure (PFCE) as well as the Government Final Consumption Expenditure (GFCE). Let’s understand the concept of slowdown. Slowdown is a decline in the GDP and its pace has decreased, however recession signifies consecutive decline in GDP for a minimum two quarters. There are two types of slowdown basically cyclical and structural.

A cyclical slowdown is a period of lean economic activity that occurs at regular intervals. Such slowdowns last over the short-to-medium term, and are based on the changes in the business cycle. Generally, interim fiscal and monetary measures, temporary recapitalization of credit markets, and need-based regulatory changes are required to revive the economy.

A structural slowdown, on the other hand, is a more deep-rooted phenomenon that occurs due to a one-off shift from an existing paradigm. The changes, which last over a long-term, are driven by disruptive technologies, changing demographics, and/or change in consumer behavior.

KEY INDICATORS OF INDIA’S ECONOMIC SLOWDOWN

-

SALE OF AUTOMOBILES -

India has seen a massive slowdown in the sale of automobiles especially four wheelers. During April to June 2019, car sales fell by 23.3% in comparison to the same period in 2018. This is the biggest contraction in quarterly sales since 2004. This has a direct impact on the tyre manufacturers to steel manufacturers to steering manufacturers etc. leading to a massive lay-off and job losses of youth. The two wheelers and trackers also had shown a significant decline in the sales. -

SALE OF HOUSES -

The money spent on buying houses has also decreased considerably. The number of houses that are being built in comparison to the ones that are being bought are quite less. This means the real estate of the country is also slowing down. If the real estate sector does well, many other sectors dependent on this sector such as steel, cement, furnishings, paints, etc., do well. However, this is not the case. -

CREDIT & OTHER OUTSTANDING AMOUNT -

Surprisingly, the credit card outstanding grew by 27.6% between April and June 2019, against 31.3% in April to June 2018. This is because a certain section of the society spends on the small budget items in the malls and restaurants leading to the increase in outstanding credit card spending. -

FMCG (Fast Moving Consumer Goods) MARKET -

According to the available data, the number of packs sold by the FMCG has decreased in the last one year. -

FALL IN IMPORTS -

The imports of goods are a direct indication of the consumption or demand. During April to June 2019, these imports fell by 5.3%, the biggest contraction in three years. They had risen by 6.3% during the same period last year. -

INVESTMENT -

This is one of the most important factors that help to know the pace at which the economy is growing. If there is an investment in the economy, it will definitely lead to job creation and with the job creation, employment level will rise ultimately leading to the increase in standard of living of people. The sale of commercial vehicles is an indicator of the industrial activity. Faster sales indicate a robust activity on the infrastructure and industrial front. Commercial vehicles are used to move around finished as well as semi-finished goods. Sales of these vehicles during April to June 2019 fell by 9.5%, the highest fall in five years. Gross Fixed Capital Formation (GFCF) is a metric to gauge investment in the economy.

DECODING CAUSES OF SLOWDOWN

- Some of the major causes of India’s slowdown are Demonetization & NPA (Non-Performing Assets), GST Implementation and problems in Agriculture sector.

- US-China trade war, which has intensified over time and has contracted world trade and, in turn, Indian exports, liquidity crisis in NBFCs, and shift in the behavioral pattern of the workforce.

- Global economy is witnessing a slow-down.

EFFORTS FROM THE GOVERNMENT’S END

- The government has introduced countercyclical measures, including sectorial incentives and confidence-building steps for the private sector, to stimulate the economy that is grinding through losses, layoffs and an investment freeze.

- The Government of India has announced a significant reduction in corporate tax rate for domestic company to 22%, if they do not seek any exemption or incentives. Effective Tax Rate would be 25.17% inclusive of all surcharges and cess for such domestic companies. Such companies are also not required to pay Minimum Alternative Tax. Any new domestic company incorporated on or after 1st Oct 2019 making fresh investment in manufacturing will have an option to pay income tax at rate of 15%. Effective tax rate for new manufacturing companies would to be 17.01% inclusive of surcharge and cess. This will be a great boost to Make in India and attract foreign investments in the country.

- Companies which continue to avail incentive or exemptions, even for them the government has provided a Minimum Alternate Tax(MAT) relief, and the MAT rate has been reduced for them to 15% from the existing 18.5%.

- No tax on buy-back of shares in case of such companies will apply.

- On 30 August 2019, Finance minister Nirmala Sitharaman announced the merger of Punjab National Bank, Oriental Bank of Commerce and United Bank with business of ?7.95 trillion to make India’s second-largest bank. The other merger will be between Canara Bank and Syndicate Bank, which will make the fourth-largest bank, with ?15.2 trillion business. Also, Union Bank will be merged with Andhra Bank and Corporation Bank to build India’s fifth-largest public sector bank with ?14.59 trillion in business. Indian Bank will be merged with Allahabad Bank to make India’s seventh-largest PSB with a business of ?8.08 trillion.

- Banks do not have to declare any stressed MSME (Micro Small and Medium Enterprises) as non-performing assets (NPA) till March 31, 2020.

- RBI has lowered the repo rate in subsequent bimonthly monetary policies and it has asked banks to pass on the lower rate cuts to the final customers. This will make the loans cheaper and increase the lending capacity of the banks as well.

WHAT MORE CAN BE DONE

- The automobile sector has been the one that is worst affected by the ongoing crisis. There have been massive layoffs and the falls have declined sharply. The government must consider to provide incentives in the form of tax rate cut or booster packages for this sector. The big players in the automobile sector needs to be provided incentives to make them expand their horizons by considering the manufacturing and production electric vehicles in the same.

- The Central bank and government needs to ensure that there in enough liquidity and credit in the market. This must be true for wholesale and retail customers.

- There needs to be massive infrastructure investments that will bring job opportunity and create employments.

- There needs to be focus on the skill development of the individuals that help them to secure and sustain the jobs they get into. Massive skill development drives that update the youth and job seekers in relation to the changing global scenarios must be considered.

- Though government has been constantly working on making the ease of doing business process easier, it has been evident in the subsequent Ease of Doing Business ranking of the World Bank. India still needs to work on red tape, land acquisition costs, inherent policies etc.

- The income tax slab needs to be revisited for individuals as well.

- The GST slabs need to be reworked.

- With the ongoing trade war between US and China, India definitely has a great opportunity to develop and boost its export. In the past also, India has always focused on being a service economy. However, it seriously needs to consider on becoming a manufacturing economy in the long run.

MANMOHAN SINGH’S FIVE POINT REMEDY FOR SLOW DOWN

- India’s former Finance Minister Dr. Manmohan Singh provided a five point remedy for extremely serious economic slow-down. He is an economist par excellence.

- First, GST should be made “logical” with the reduction in tax slabs. This would mean a revenue loss for a brief time.

- Second, devise new ways to both, revive the agriculture and boost rural consumption.

- Third, there is a need to infuse liquidity in the system for capital formation.

- Fourth measure is to revitalize key labor-intensive sectors such as textile, automobile, electronics and affordable housing. For that easy loans would be required, especially for micro, small and medium enterprises (MSMEs)

- Fifth measure pertains to harness emerging export opportunities because of the ongoing tariff war between the United States and China.

The government has been announcing a slew of reforms on a regular basis to help economy revive and also achieve the target of becoming a $5 trillion economy. However, the slowdown has been massive which means it will take time for the economy to be back on track and will take time to show results.

Nisha sharma

Very valuable study material.